What is a BPO and what are they used for?

In the third quarter of last year, 38% of homes in Pierce County were distressed home sales, meaning they were Short Sales or Bank Owned Homes. If you are in the process buying or selling one of these distressed homes, you have probably heard the term “BPO” which stands for Broker Price Opinion. Broker Price Opinion’s are similar to a price appraisal, but are performed by Real Estate Agents.

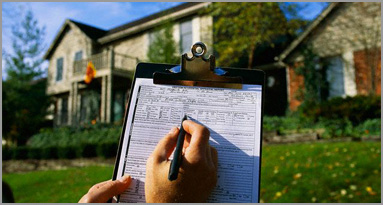

Typically an agent will be asked to take pictures of the house and compare it to currently listed and recently sold properties in the immediate area. BPO’s are used in a variety of scenarios around distressed homes, but also by relocation companies. If you’ve ever seen a car slow down and snap pictures of a house and drive off, you might have just seen a drive by BPO! Here are some common examples of when BPO’s are needed to help determine value:

When Banks List Foreclosed Properties: After foreclosing, banks hire real estate agents, appraisers, and inspectors to visit a property and give an opinion of what the house would sell for on the market right then. WIth a lot of banks being across the country it gives them an idea of what’s going on locally and helps them make informed decisions. They will usually get more than one to make sure the price is right when it goes on the market.

When someone is trying to modify their loan: Sometimes when a person is attempting to modify their interest rate or work with their bank on changing their loan, the bank will order one (or more) BPO’s in order to find out if the property has lost value since the loan was made.

Evaluating Short Sale Offers: When a bank is trying to decide whether or not to accept an offer from a buyer on a short sale, they will often order a BPO to get an independent idea of the market value of the house.

Since BPO’s are not as in depth as an appraisal, they can be a controversial method for determining the value of a house- but since BPO’s typically cost banks less than 25% of the cost of an appraisal, they have become an increasingly important component in pricing bank owned and short sale homes.